Thinking of retiring from your job as a federal worker? Congratulations! You’ve put in a long career of public service, and now it’s time to reap the rewards of that great benefits package you’ve heard so much about over the course of your career.

Unfortunately, you do have to jump through some hoops to complete the retirement process and receive your pension. It’s a time-consuming process — and if you’re not careful, an expensive one. The truth is that the Office of Personnel Management (OPM) has a lot of paperwork to get through, and you won’t get your full retirement payments until they review it all.

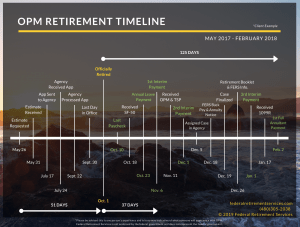

Though the OPM’s stated goal is to process retirement paperwork within 60 days, it often takes longer. Since the pandemic, the average processing time has been more like 90 days for retirees.

Why does it take so long? There are a lot of moving parts.

Your Retirement Paperwork Timeline

Submitting your FERS retirement application is only the beginning. First, your department’s personnel office will have you sign off on several documents and begin the work of verifying your service — something that can take extra time if any documentation is missing. They also transfer your life insurance (FEGLI) and health insurance (FEHB) enrollment to the OPM.

Then it’s the payroll office’s turn. When they receive your paperwork from personnel, they authorize your final paycheck and your payout of unused annual leave. They also forward records of your salary, retirement contributions, and service history to the OPM.

Once OPM finally has your full paperwork packages from these other departments, they provide you a civil service claim number to keep track of everything. And then you wait for them to review your eligibility, calculate your annuity, and — finally! — send you that check.

So how long does all of this take? Here’s the general timeline as it stands today:

- Day 1: Your retirement date. Congratulations! Throw away your alarm clock and start those hobbies you’ve been dreaming about.

- Day 30: TSP funds available for withdrawal. The payroll office will let TSP know you’re retiring automatically, and you should be able to access these savings without penalty within 30 days of retirement.

- Day 30-45: Annual leave lump sum payment sent. It takes at least two full pay periods after your retirement date to process this payment, and often up to six weeks to receive it. This is the responsibility of the payroll department.

- Day 45-70: OPM sends first retirement letters. Somewhere between six and 10 weeks after your retirement date, OPM will send you your Civilian Service Annuity Number (CSA#), which you will need any time you contact them in the future. They will later send a letter with an online password for you to use to set up future communication.

- Day 45-70: OPM sends interim retirement check. After you receive your first letters, you’ll get your first annuity check — but this will only be for 60-80% of your expected annuity. This is just to tide you over while they process the paperwork and should get to you within six to 10 weeks of your retirement date as well.

- Day 90-120: OPM sends your full retirement check. Once they finally get through your paperwork, OPM cuts you a check for the full amount of your annuity. This catches you up on what you were owed from the interim check, minus insurance and taxes. It can take three to six months for this full check to arrive.

Worth repeating: It can take up to six months before you receive your full retirement benefits. Because of this, it may be helpful to file your paperwork 60-90 days prior to your retirement date.

It’s also a good idea to have a financial plan in place to cover you while you wait for your annuity to kick in. You don’t want to fall into the OPM trap of using credit cards to get by for those months, so consider working with a financial planner to come up with a solid strategy to get you through this period.

Other Things to Remember

Although your life and health insurance premiums will eventually be deducted from your full retirement check and your coverage will continue as you await OPM processing, not all of your benefits will be covered automatically during the transition period.

If you have additional FEDVIP Dental/Vision coverage or LTCFEDS Long Term Care insurance, you’ll need to contact those providers directly to make payments while you wait for your full retirement check to be processed.

Likewise, any personal allotments you have set up through payroll will stop once you retire. You can resume these through the OPM once your final retirement check is processed.

Finally, you will no longer be able to contribute to a Flexible Savings Account (FSA) once you retire. However, you can still access any remaining balance to get reimbursed for qualified expenses you made before your retirement date.

Important Contacts

If you find that your retirement process is delayed past the dates on the timeline above, you’ll want to get proactive to find out what’s happening. You’ll also want to make sure you contact the right department for each issue you face:

Thrift Savings Plan (TSP): (877) 968-3778 or www.tsp.gov

OPM: (888) 767-6738 or www.opm.gov

BENEFEDS (Dental/Vision): (877) 888-3337 or https://www.benefeds.com

LTCFEDS (Long Term Care): (800) 582-3337 or https://www.ltcfeds.com

FSA: (877) 372-3337 or https://www.fsafeds.com

Social Security: (800) 772-1213 or www.ssa.gov

Medicare: (800) 633-4227 or www.medicare.gov

The Bottom Line

Retirement planning for federal employees can feel overwhelming, but if you start early, you can make sure your paperwork is flawless for easier processing. You’ll also need to make sure you have a plan to cover your expenses while you wait for the OPM to process your paperwork and send that first full check.

We’re here to help! We’re experts in the federal retirement system and can help you develop a wealth management plan that will let you enjoy your first days of retirement instead of running to the mailbox every day to look for that check. Get in touch to get started today.

Life insurance can be a tricky subject. For starters, no one likes to talk about it — after all, discussing your own death isn’t exactly a fun conversation. Still, it’s incredibly important to take the time to figure out how much your family could lose if you died unexpectedly — and then take steps to get the right life insurance coverage to protect them.

As a federal employee, you’ve got some great options for life insurance as part of your benefits package. The Federal Employees’ Group Life Insurance (FEGLI) Program covers about 4 million people and the government picks up a third of the tab for Basic coverage, making it a great financial deal.

But is the Basic plan enough? Here’s what you need to know to make sure your family is protected.

FEGLI Basics and Options

Nearly all federal employees are eligible for FEGLI coverage, and you are automatically enrolled in the Basic plan when you are hired. That means that your cost comes out of your paycheck, and you probably won’t even notice.

Basic FEGLI coverage will pay your designated beneficiary one full year’s salary plus $2,000 when you die. However, there is an extra benefit for younger employees. If you are age 35 or under at the time of your death, the FEGLI benefit is 200% of your annual salary. Between the ages of 35 and 45, this extra benefit decreases by 10% each year until it disappears at age 45. At that time, you’re back to the standard benefit of 100% of your salary.

If you’d like to provide more for your family, there are three optional FEGLI plans to consider:

- Option A: Pays out an additional $10,000 upon your death.

- Option B: Pays out an additional multiple of your annual salary. You can choose coverage from 1 to 5 times your annual income.

- Option C: Pays out up to $25,000 for the death of a spouse and up to $12,500 for the death of a child if you choose to cover immediate family members.

It’s important to note that you’ll be paying the full premium for any additional coverage you choose: the government doesn’t subsidize FEGLI options, only the basic coverage.

The cost of optional coverage also rises as you get older. By the time you are in your 60s, the premium will be more than 10 times what you paid when you were 30, so it’s a good idea to review your financial plan regularly to make sure you aren’t paying for coverage you no longer need as you get older.

How Much Life Insurance Do You Need?

This is a highly personal question, and a tailored answer will depend on many factors, including your age, your assets, the size of your family, whether you’re their primary source of income, and more. But in general, you can get a sense of your family’s needs by looking at your annual income and expenses.

For starters, how much money would your family lose if you died, and how many years of replacement income would they need? One easy calculation is to take your annual income and multiply it by the years you have until retirement. This amount would provide your surviving family members the money you would have provided until you stopped working.

But this might be more money than your family actually needs. If your house is paid off, you have no debt, and your spouse is working full time, full income replacement probably isn’t necessary. So as you fine-tune your number, consider how much your family may require. You can get an idea based on your annual spending right now, but make sure to consider additional expenses such as:

- Childcare costs

- College costs

- Mortgage payoff costs

- Consumer debt

- Funeral costs

- Health insurance costs (if your family loses coverage when you die)

Once you have a good idea of how much your family would need to survive without your income, you’ll need to decide how long they’ll need any replacement income to last. If you have young children, you’ll want to multiply their annual “need number” by as many years as your children will need support. For most people, that’s until they graduate from college at age 22 or so.

How to Get Help When You Need It

If this feels overwhelming, you’re not alone! It can be very challenging to estimate your family’s need when so many unknowns will affect the equation. Fortunately, a life insurance calculator can help take some of the guesswork out of your calculations and give you a better sense of the right amount of coverage for your family. It’s also a great way to fine-tune your coverage after major life events and as your needs change based on age.

When you begin to run the numbers, one thing is clear: most people will need more than just FEGLI Basic coverage to help their loved one through a difficult time. One year’s salary may simply not be enough. If that’s the case for you, explore your FEGLI options and comparison shop private rates as well.

Finally, if you need additional help deciding what coverage is right for you, please get in touch. Life insurance is just one part of a comprehensive financial plan, and we’re here to help make sure you’re on the right track for a good life and a great retirement. Contact us for more help navigating your federal benefits today.

The whole point of a Thrift Savings Plan (TSP) is to put away extra money, little by little, to add up to big savings by the time you retire. When it comes to retirement savings, the first rule is not to touch that money until you retire, no matter how tempting it might be to dip into those funds for other purchases (or in case of emergency).

That’s sound advice, but there are exceptions to every rule. When it comes to the TSP, did you know that you’re allowed to take money out — penalty-free! — before you retire? And that it can actually be a good idea under the right circumstances?

Welcome to the wonderful world of age-based withdrawals. Here’s what you need to know to make them work for you.

What Is an Age-Based In-Service Withdrawal?

Generally speaking, your TSP money is off-limits while you’re still working in your government position. However, an age-based in-service withdrawal allows you to take money out of your TSP while you’re still working as long as you have reached age 59½.

In addition to being old enough to qualify, you also need to meet a few additional requirements:

- You can only withdraw from funds in which you are fully vested (i.e., you have enough years of service to do so).

- You must withdraw at least $1,000.

- If you have less than $1,000 in your TSP, you must withdraw the entire amount.

- You can make a maximum of four age-based withdrawals per year.

What’s the Catch?

Keep in mind your withdrawal is subject to a 20% federal income tax unless you roll it over into another eligible retirement plan such as an IRA.

So if you plan to spend the money, you’ll be taxed on the portion that came from traditional TSP funds, but not Roth funds.

On the other hand, you have the opportunity to roll your TSP funds into an IRA account totally tax- and penalty-free.

Change your mind after you have moved money into an IRA? You can move your money back to the TSP as long as you keep your account open by maintaining a minimum balance.

What’s the Advantage?

The TSP is a great benefit, but your investment options are pretty limited. Right now you can only choose from five different index funds, and you’re stuck managing that money yourself. This means that when you retire, it will be all on you to make sure your investments are well-balanced and that you time selling shares and taking distributions to minimize your taxes and make sure your money is invested as wisely as possible.

That’s a tall order, especially if you’d rather relax during your retirement than worry about your money.

If you roll over your TSP funds into a private IRA, though, you can let an investment fiduciary take charge of managing your money. For many people, this comes as a huge relief. It allows you to streamline your retirement management and get great advice so you don’t have to worry about your TSP money in an economic downturn. It also gives you the freedom to invest in a much broader range of ETFs, mutual funds, stocks, bonds, annuities and more — anything that you and your advisor decide is right for your plan is now available outside the confines of the TSP.

An age-based withdrawal also provides you the opportunity to convert a traditional TSP to a Roth IRA. A Roth conversion will require you to pay taxes on the money you roll over, but once you do, you’ll never have to pay taxes on it again. Additionally, Roth IRAs are not subject to Required Minimum Distributions (RMDs) once you reach age 72. This is a huge advantage for anyone who is happy to live on their pension and would like to keep their IRA intact to pass on to their heirs — or just to keep it for as long as possible before spending it down.

What’s Next?

To make an age-based in-service withdrawal, you’ll need to log into your TSP account and click on the withdrawals section. From there, you can complete your request for the withdrawal online. Funds are delivered via direct deposit, electronic transfer, or paper check. From there, you can transfer the money to your IRA — just make sure to hang onto the paperwork as you do so to show the IRS that your withdrawal was actually a rollover.

Age-based withdrawals are often a “hidden” benefit of TSPs, and many people never take advantage. If you’d like to learn more about rolling over your TSP funds into a professionally managed IRA or making that Roth conversion to avoid RMDs, we’re here to help! Please get in touch to learn more about our specialized financial planning for federal employees today.